At Which Stages of Money Laundering Are Credit Cards Used

Criminals may for example use their illegal funds to purchase large numbers of prepaid cards and then introduce their stored value into the legitimate financial system or transport the cards overseas to avoid the scrutiny of authorities. For example the credit card monthly payment is 0 and the client makes an overpayment of 10000.

What Is Anti Money Laundering A Guide To Getting Started Plaid

A it relieves the criminal of holding and guarding large amounts of bulky of cash.

. At banks the division of huge sums of money into several little transactions often called smurfing. Also this week I learned gift cards are anonymous and basically untraceable. Transactions designed to launder funds can for example be effected in one or two stages depending on the money laundering technique being used.

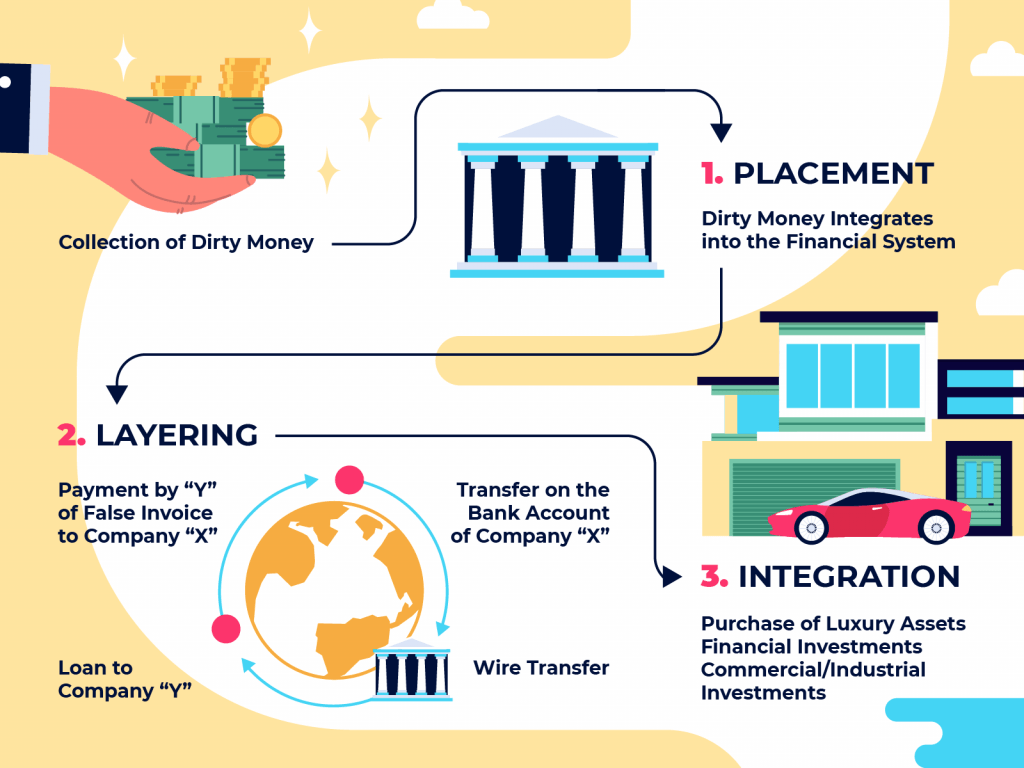

Placement layering and integration are all stages of money laundering which makes illegal money legal. Integrating illegal money into the economy with credit cards. They are more likely to be used in the layering or integration stages.

The layering stage involves the separation of proceeds from their illegal source by using multiple complex financial transactions eg wire transfers monetary instruments to obscure the audit trail and hide the proceeds. The stages of money laundering include the. Customer identification is required Cash payments are generally restricted Credit refunds have a waiting period Credit cards can access ATMs globally.

To turn the proceeds of crime into cash or property that looks legitimate and can be used without suspicion. Pg 25 of the Study Guide. Cash payments are generally restricted.

They can then use them to both move and transform illegal funds and also use them at the various stages of money laundering. The following are the stages of money laundering process. Credit card laundering sometimes referred to as factoring works like this.

Structuring and placement are methods of disposing cash which many credit cards do not permit. The nature of the card product itself creates certain structural controlsrestrictions at the Placement and Integration stages of the money laundering lifecycle eg. The second stage is layering.

Why would a credit card account likely not be used in the placement stage of money laundering. Cash payments are generally restricted C. The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system.

The third method involves the use of credit cards. Money launderers can also use credit cards to integrate illegal money into the financial system. Credit card accounts are not likely to be used in the initial placement stage of money laundering because the industry generally restricts cash payments.

A company that does not have a credit card merchant account with a bank or credit card company recruits another company. Ii there are similar. They are more likely to be used in the layering or integration stages of money laundering.

I credit line facilities generally limit the amount of currency that can be accessed by card holders. Credit refunds have a waiting period D. They do this by maintaining an offshore account in another jurisdiction through which payments are made.

The final stage is getting the money out so. Money laundering has one purpose. Answer 1 of 2.

One example of using credit cards for money laundering purposes is overpaying a. Among the traditional methods of money laundering are. One example of using credit cards for money laundering purposes is overpaying a credit card balance and then asking for a refund.

- The object of this stage is to prevent the tracing of illegal proceed. Generally Credit cards are not used in the placement. Generally this stage serves two purposes.

Placement stage - It is the first introduction of entry for funds derived for any criminal activities. Credit cards can be used to launder in the following ways. Customer identification is required B.

They are more likely to be used in the layering or integration stages. Smurfing lodging small amounts of money below the AML reporting threshold to bank accounts or credit cards then using these to pay expenses etc. They are more likely to be used in the layering or integration stages of money laundering.

The correct answer is B. The third stage in the money laundering process is integration. Not all money laundering transactions go through this three-stage process.

Prepaid cards can be used at the placement layering and integration stages of money laundering. Let me say this first. And b it places.

Making large payments in excess of the amount due which creates a large credit balance. Why would a credit card account likely not be used in the placement stage of money laundering. Customer identification is required.

Generally Credit cards are not used in the placement. Credit cards can access ATMs globally. Financial Crimes Enforcement Network FinCEN treats transaction laundering as any other type of money laundering meaning that businesses found guilty can expect the same intense scrutiny and low level of tolerance from the agency.

Effective as a vehicle for money laundering. Layering Agitation stage. They are used for layering and integration.

Why would a credit card account likely not be used in the placement stage of money laundering. The money laundering process doesnt stop with the Mexican merchant but the TOCs successfully passed the first step in the money laundering process by distributing cash to various businesses by converting cash deliveries into a bank deposit through the use of. Not only is transaction laundering aga.

At which stages of money laundering are credit cards used. Bank regulators and credit card industry representatives we interviewed acknowledged that credit card accounts might be used in the layering or integration stages of money laundering. Credit cards can access ATMs globally.

Stage of money laundering when illicit cash is first placed into the financial system because the industry generally restricts cash payments. The three basic stages may occur as separate and distinct phases or may occur simultaneously or more commonly they may overlap. In this scenario prepaid cards are purchased by criminals in bulk using illegal funds and then moved cross-border to less-regulated countries or the value is converted into legal tender.

This is unusual for a credit card as most clients owe money to the bank not the other way around. Credit card accounts are not likely to be used in the initial placement stage of money laundering because the industry generally restricts cash payments. Credit refunds have a waiting period D.

How Money Laundering Really Works Why It S A Problem In The Gambling Industry Casino Org Blog

About Business Crime Solutions Money Laundering A Three Stage Process

Understanding Money Laundering European Institute Of Management And Finance

Comments

Post a Comment